Last week, The Big Crunch took a look at the historical precedent for periods like last week, predicting that this week will be very volatile.

So far, it looks like we were right: The Dow Jones industrial average fell more than 350 points into correction territory after the open Tuesday morning. At midday, the S&P 500 was down 2.5 percent.

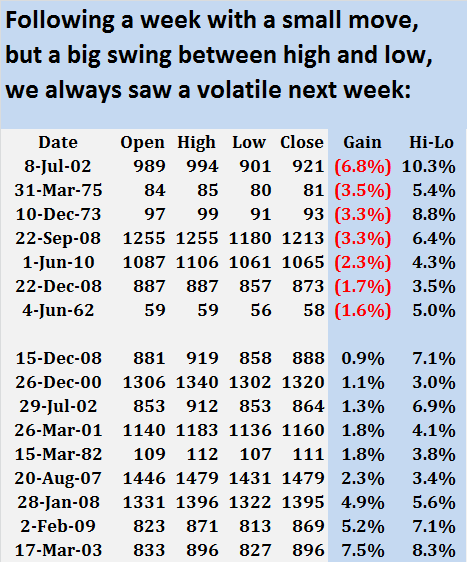

The week of Aug. 24 was one of only 17 weeks since 1950 in which the S&P 500 saw a high-low difference of more than 6 percent and a relatively flat return—between -1 and +1 percent. That combination of a big swing and small weekly return is very unusual, and it consistently leads into another week of big swings.